Multi-hypothesis prediction for portfolio optimization: A structured ensemble learning approach to risk diversification

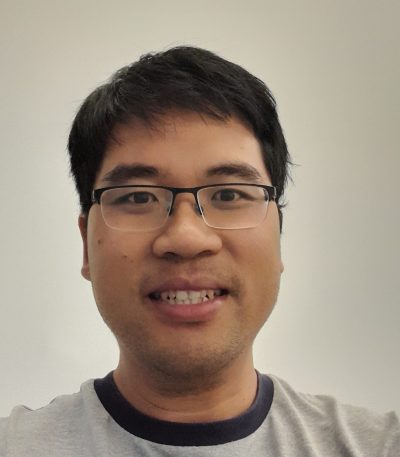

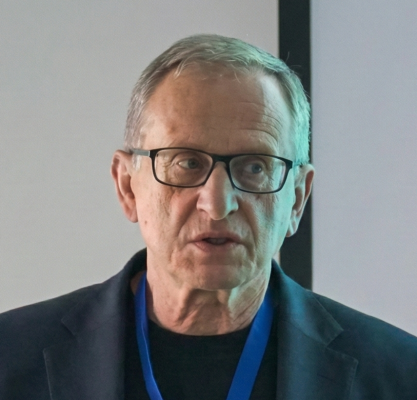

via ZoomSpeaker: Dr. Alejandro Rodriguez Dominguez, Director of Quantitative Analysis and Artificial Intelligence, Miralta Finance Bank, Madrid. Abstract: We introduce a novel framework for portfolio construction, covering both selection and optimization, based entirely on ensemble learning theory. A portfolio is modelled as an ensemble in a multi-hypothesis prediction setting, with each constituent (base learner) focused on […]